studyplus.site Learn

Learn

0 Dollar Annual Fee Credit Card

Here's why: The U.S. Bank Visa® Platinum Card could help you handle debt with no annual fee. The card gives you a year and a half to deal with debt with a 0%. The Capital One Quicksilver Cash Rewards card is our best overall credit card and best for cash back because of its combination of low fees, low interest, and. FULL LIST OF EDITORIAL PICKS: BEST NO ANNUAL FEE CREDIT CARDS · Wells Fargo Active Cash® Card · Chase Freedom Unlimited® · Citi Double Cash® Card · Discover it®. The no annual fee travel card that turns your everyday purchases into a dream vacation. 1 point per $1 directly with Air Canada® and Air Canada Vacations®, 2; 1. No foreign transaction fees. no, yes. Annual fee. $69, $ Don't see the card for you? Check out our other options: Premier card. Earn 50, points, plus. $0 annual fee. 0% intro APR for 12 months from account opening on purchases. %, %, or % variable APR thereafter. Up to $ of cell phone. Find the best Chase no annual fee credit cards with cash back, rewards, and sign up bonuses. Compare our different card benefits and apply today for a no. Annual fees can range anywhere from as little as $20 to as high as a few hundred dollars, depending on the card. Examine the pros and the cons of the best. Looking for Credit Cards with no annual fees? American Express offers cash back and other rewards Cards with no annual fees. Apply now! Terms apply. Here's why: The U.S. Bank Visa® Platinum Card could help you handle debt with no annual fee. The card gives you a year and a half to deal with debt with a 0%. The Capital One Quicksilver Cash Rewards card is our best overall credit card and best for cash back because of its combination of low fees, low interest, and. FULL LIST OF EDITORIAL PICKS: BEST NO ANNUAL FEE CREDIT CARDS · Wells Fargo Active Cash® Card · Chase Freedom Unlimited® · Citi Double Cash® Card · Discover it®. The no annual fee travel card that turns your everyday purchases into a dream vacation. 1 point per $1 directly with Air Canada® and Air Canada Vacations®, 2; 1. No foreign transaction fees. no, yes. Annual fee. $69, $ Don't see the card for you? Check out our other options: Premier card. Earn 50, points, plus. $0 annual fee. 0% intro APR for 12 months from account opening on purchases. %, %, or % variable APR thereafter. Up to $ of cell phone. Find the best Chase no annual fee credit cards with cash back, rewards, and sign up bonuses. Compare our different card benefits and apply today for a no. Annual fees can range anywhere from as little as $20 to as high as a few hundred dollars, depending on the card. Examine the pros and the cons of the best. Looking for Credit Cards with no annual fees? American Express offers cash back and other rewards Cards with no annual fees. Apply now! Terms apply.

Credit level: Excellent Good Fair Rebuilding ; Card type: Student Secured Business Personal ; Rewards: Cash Back Travel Dining $0 Annual Fee. Discover it® Secured Credit Card · N/A on purchases ; Capital One VentureOne Rewards Credit Card · 0% intro APR on purchases and balance transfers for 15 months. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. No Annual Fee Apply Now. Must apply here for this offer. Offers vary 0% interest rate. Q: If I request a balance transfer, will you process the. Find no annual fee credit cards from Mastercard. Compare cards from our partners, view offers, and apply online for the credit card that best fits your needs. The $0 annual fee and an introductory month 0% APR make this card particularly attractive to budget-conscious cardholders. Rewards. Earn 40, bonus miles after you make $2, in eligible purchases on your Card in the first 6 months.†. $0 introductory annual fee for the first year, then. Wells Fargo Active Cash® Card. Visa Signature®. Visa Infinite®. Wells Fargo Active Cash® Card. INTRO PURCHASE APR. 0% intro APR for 12 months from account. Wells Fargo Active Cash® Card. Apply Now. Base rewards rate: 2% cash rewards on purchases · Annual fee: $0 ; Capital One SavorOne Cash Rewards Credit Card. Learn. Annual Fee: $0. APR: 0% intro APR on purchases and balance transfers. The best credit card with no annual fee is the Wells Fargo Active Cash® Card because it is twice as rewarding as the average cash back credit card. Credit cards with no annual fee offer the flexibility of credit without the cost of a yearly fee. Bank of America® Cash Rewards Credit Card. No Annual Fee Credit Cards ; Citi Rewards+® Credit Card · on purchases & balance transfers · 20,Bonus Points ; Citi® Diamond Preferred® Credit Card · on balance. You don't need an annual fee for generous credit card rewards and top benefits. At Discover, every credit card has no annual fee. In place of flashy sign-up bonuses, many no-annual-fee cards offer new members 0% APR interest on new purchases and balance transfers for a set amount of time . No annual fee means that a credit card doesn't charge you a yearly fee simply for using your card. This can offer you more flexibility, as you won't need to get. TD Business Select Rate Visa. Have option to choose no annual fee with an % interest rate, or if you often carry a balance, you can choose to pay an annual. Our Top No Annual Fee Credit Cards in Canada ; RBC ION Visa · Enjoy 6, Avion welcome points upon approval – that's a value of $40 in gift cards. Apply by. Probably get the most value from the Chase Freedom just due to transferring to Hyatt. However, Citi Custom Cash is another no annual fee card. Additional Card Benefits ; Contactless Payment Icon. Contactless Payment ; Padlock Icon. Zero Fraud Liability ; Credit Score Icon. Free Online Access to Credit.

Nyc Personal Income Tax

New York City income tax rates are %, %, % and % depending on your tax bracket and filing status. Remember that NYC income tax is in. Find IRS mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in New York. State income tax rates range from 4% to %, but you may be able to lower your tax bill with various deductions and credits. These include a standard. As a result, there is no reason to withhold more than % of all taxable distributions and taxable income to the State of Delaware. For information regarding. If you are married and filing a joint federal income tax return but one spouse is a New York State resident and the other is a nonresident or part-year resident. As shown in Figure 4, the personal income tax share of total New York State tax receipts has grown New York City's High-Earner Tax Hike. Although the. New York has a graduated state individual income tax, with rates ranging from percent to percent. Residents of New York City and Yonkers may end up paying more personal income tax than taxpayers who live in other cities in the state. You may be subject. New York has a graduated state individual income tax, with rates ranging from percent to percent. New York City income tax rates are %, %, % and % depending on your tax bracket and filing status. Remember that NYC income tax is in. Find IRS mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in New York. State income tax rates range from 4% to %, but you may be able to lower your tax bill with various deductions and credits. These include a standard. As a result, there is no reason to withhold more than % of all taxable distributions and taxable income to the State of Delaware. For information regarding. If you are married and filing a joint federal income tax return but one spouse is a New York State resident and the other is a nonresident or part-year resident. As shown in Figure 4, the personal income tax share of total New York State tax receipts has grown New York City's High-Earner Tax Hike. Although the. New York has a graduated state individual income tax, with rates ranging from percent to percent. Residents of New York City and Yonkers may end up paying more personal income tax than taxpayers who live in other cities in the state. You may be subject. New York has a graduated state individual income tax, with rates ranging from percent to percent.

If a husband and wife file separate Federal income tax returns, they must also file separate New York State personal income tax returns on separate forms. in the city. All city residents' income, no matter where it is earned, is subject to New York City personal income tax. Nonresidents of New. State income tax is imposed at a fixed or graduated rate on taxable income of individuals, corporations, and certain estates and trusts. Residents: Graduated progressive rates up to 35%. Non-residents: Varies depending on type of income. For salaries, progressive rates up to 30%. Moldova (Last. Any New York City employee who was a nonresident of the City (the five NYC boroughs) during any part of a particular tax year must file an return. The personal income tax rate in New York uses tax brackets based on the level of income, just like the federal system. The tax rate starts at 4% for income. You can submit the NYC with your. New York State personal income tax return by including FORM NYC If you file only the NYC and don't file a New. ¶, NYC Personal Income Tax Forms in Current Use ; IT Lump Sum Distributions Supplement to Form IT ; IT Resident Income Tax Return (Short. Due Date - Individual Returns - April 15, or the same as the IRS. Extensions - The New York Tax Department does not accept federal Form in place of an NYS. New York is a high-tax state, regularly coming in as one of the highest in the country with a top marginal tax rate at %. New York City applies an. Data on the income and personal income tax (PIT) liability of New York City residents grouped by income ranges is available by tax liability (calendar) year. New York City's income tax system is also progressive and rates range from % to %. New York imposes tax at graduated rates between 4% and %. New York City taxes also its residents at graduated rates up to %. %. New York City's combined city and state personal income tax rate is higher than any place in America except California. 42%. Since fiscal year , New York City residents with positive UBT liability have been able to claim a credit against their city personal income tax (PIT). [email protected] or at and/or the New York City Law Department at [email protected] Hosted by: American Legal Publishing. The personal income tax rate in New York uses tax brackets based on the level of income, just like the federal system. The tax rate starts at 4% for income. The top end for personal state taxes in New York was recently raised from % to %. Corporation Franchise Tax. Most small businesses are not traditional C. New York has fairly high income tax rates, and New York City's are even higher, ranging from an additional % to %. Taxes. Components of NYC Personal Income Tax Collections. Estate Tax Collections. Real Estate Transfer Tax Collections. Total Mortgage Tax Collections. This.

How To Figure Out Total Interest Paid On A Loan

This calculator determines your mortgage payment and provides have paid $, in principal, $74, in interest, for a total of $, Interest rate. Your interest rate is the percentage you'll pay to borrow the loan amount. Borrowers with strong credit may be eligible for a lender's lowest. To calculate the total amount of interest paid over the 60 payments, first multiply the monthly payment by the total number of payments or the nper. The rate argument is the interest rate per period for the loan. For example, in this formula the 17% annual interest rate is divided by 12, the number of months. Interest on your loan accrues daily. It is for this reason that the portion of your monthly payment allocated to interest may fluctuate. To calculate the. Principal Amount x Interest Rate x Time (in years) = Total Interest; Divide the total interest by the number of months in your loan term to find the monthly. Total Interest Paid. $ , Loan Amount. $ , Payment Figure out how much the loan will ultimately cost you in total interest. Two. This loan calculator allows you to easily see your monthly payments and total interest on a loan Before taking out a loan, it's beneficial to know how. Use Excel to Find the Payment and Total Interest on a Loan · Amount of loan = 13, · Annual interest rate = % · Length of the loan = 6 years. This calculator determines your mortgage payment and provides have paid $, in principal, $74, in interest, for a total of $, Interest rate. Your interest rate is the percentage you'll pay to borrow the loan amount. Borrowers with strong credit may be eligible for a lender's lowest. To calculate the total amount of interest paid over the 60 payments, first multiply the monthly payment by the total number of payments or the nper. The rate argument is the interest rate per period for the loan. For example, in this formula the 17% annual interest rate is divided by 12, the number of months. Interest on your loan accrues daily. It is for this reason that the portion of your monthly payment allocated to interest may fluctuate. To calculate the. Principal Amount x Interest Rate x Time (in years) = Total Interest; Divide the total interest by the number of months in your loan term to find the monthly. Total Interest Paid. $ , Loan Amount. $ , Payment Figure out how much the loan will ultimately cost you in total interest. Two. This loan calculator allows you to easily see your monthly payments and total interest on a loan Before taking out a loan, it's beneficial to know how. Use Excel to Find the Payment and Total Interest on a Loan · Amount of loan = 13, · Annual interest rate = % · Length of the loan = 6 years.

Loan amount. Total amount of your loan. Payment. Payment for this loan. Interest rate. Annual interest rate for. Simply enter your loan amount, term, interest rate and date of first payment and click calculate. Estimate your monthly loan payment amount. Loan Type (Optional). Or, enter in the loan amount and we will calculate your monthly payment. You can then examine your principal balances by payment, total of all payments made. Use the Loan Calculator to determine your regular payments, along with the total loan amount (principal and interest), and see how increasing your payments. Now that you know your total interest, you can use this value to determine your total loan repayment required. ($10, + $2, = $12,) You can also divide. Use this loan payoff calculator to find out how many payments it will take to pay off a loan. All fields are required. Purchase price. Down payment amount. Find the right strategy to realize your goal. Calculate your loan details and determine the payment options that best suit your financial needs. To calculate the total interest for a loan in a given year, you can use the CUMIPMT function. In the example shown, the total interest paid in year 1 is. Calculating Interest Rates · I stands for the amount paid in interest that month/year/etc. · P stands for the principle (the amount of money before interest). · T. Divide the loan amount by the interest over the life of the loan to calculate your monthly payment. Several factors can change your monthly payment amount. If. Interest on a loan, such as a car, personal or home loan, is usually calculated daily based on the unpaid balance. Once you provide the loan amount, interest rate and term, the loan calculator will estimate your monthly payment and total interest. It also will show you a. Interested in getting a personal loan? Use Upstart's loan calculator to get an estimate of your monthly payments and total interest costs. Here are more details on the information you'll need to estimate your monthly loan payment. Loan amount; Loan term; Interest rate. Loan amount. This is the. Interest amount = loan amount x interest rate x loan term. Just make sure to convert the interest rate from a percentage to a decimal. For example, let's say. Loan amount: Total dollar amount of your loan. · Interest rate: The annual interest rate, often called an annual percentage rate (APR) for this loan or line of. Log in to your account and go to the loan details page. · Locate your current balance, interest rate, and repayment term. APR = (((Interest charges + fees) ÷ Loan amount) ÷ Number of days in loan term x ) x A formula shows how to calculate APR. First, add interest charges. (The loan calculator can be used to calculate student loan payments, auto loans or to calculate your mortgage payments.) Want to find your interest rate?

Penny Stock Chat

Penny Stocks. By Gilbert Andrew. Brief and insightful guide to promising penny stocks. Sign up to chat. Sign up or Log in to chat. FOMO is an aspect of all stock trading, of course, not just penny stocks. This is especially true if they take place in unmonitored penny stock chat rooms. Penny Stock Forum offers: Portfolio Management Live chat room, penny stock picks, penny stock reviews shared research and stock tips IPO's, trade ideals. ” Sure, chat rooms for stock traders have been around since before Now it's like six or seven penny stocks that have jacked up You. Penny Stock Forum offers: Portfolio Management Live chat room, penny stock picks, penny stock reviews shared research and stock tips IPO's, trade ideals. See a list of the most recent Stock Forum posts on Stockhouse. Browse posts by Sector and Subsector. This page provides a list of penny stocks (those trading between and ) sorted by the highest 5-day percent change. These high-volatility stocks. Welcome to studyplus.site Penny Stocks (studyplus.site) is the top online destination for all things Micro-Cap Stocks. On studyplus.site you will find a. Find the latest discussion of UNDERVALUED PENNY STOCKS on iHub's community. Penny Stocks. By Gilbert Andrew. Brief and insightful guide to promising penny stocks. Sign up to chat. Sign up or Log in to chat. FOMO is an aspect of all stock trading, of course, not just penny stocks. This is especially true if they take place in unmonitored penny stock chat rooms. Penny Stock Forum offers: Portfolio Management Live chat room, penny stock picks, penny stock reviews shared research and stock tips IPO's, trade ideals. ” Sure, chat rooms for stock traders have been around since before Now it's like six or seven penny stocks that have jacked up You. Penny Stock Forum offers: Portfolio Management Live chat room, penny stock picks, penny stock reviews shared research and stock tips IPO's, trade ideals. See a list of the most recent Stock Forum posts on Stockhouse. Browse posts by Sector and Subsector. This page provides a list of penny stocks (those trading between and ) sorted by the highest 5-day percent change. These high-volatility stocks. Welcome to studyplus.site Penny Stocks (studyplus.site) is the top online destination for all things Micro-Cap Stocks. On studyplus.site you will find a. Find the latest discussion of UNDERVALUED PENNY STOCKS on iHub's community.

Top 3 Penny Stock Trading Chat Rooms · 1. Nathan Michaud's Investors Underground Chat Room · 2. Ross Cameron's Warrior Trading Chat Room · 3. Timothy Sykes'. Stock Trading Prop Firm - Trade More Than Stocks and ETFs - Even Penny Stocks. TTP stocks prop firm is where you ought to be! LIVE STOCK CHAT! Featured Penny Stock Updated Daily! Must See Video Sneak Peek! Over Views!!! studyplus.site?v=cuo0GT-8PQs Number 1. well yeah i used limits, but on penny stocks as small as you're talking, just one price update can result in hundreds dollars difference, if you bought a few. Find the latest discussion of HOTTEST PENNY STOCK PICKS on iHub's community Chat and the latest Company filings. studyplus.site The best Penny Stock forums, communities, discussion and message boards curated from thousands of forums on the web and ranked by popularity. Analyzes NASDAQ penny stocks, focusing on reverse splits, dilution, and daily price movements. Sign up to chat. Sign up or Log in to chat. Penny stock picks and talk: Stock picking site with message boards, hot penny stock picks, bulletin boards and a live trading chat room. Penny stocks or penny shares are a common stock that trade for less than Telephone calls and online chat conversations may be recorded and monitored. OTCMethod is not just a stock trading mentorship program but also a community to find the best ideas possible from an otc stock discord. Leverage the. Free Access to The Fastest Growing Highest Rated Trading Chatroom. Subscribe Unsubscribe at anytime. Privacy Policy. penny stocks text message. The StackedBid Chat Room has 6 pro traders in it every day. The pro traders share their watch lists, trade ideas, and market outlook with all of our members. Xtradse the most profitable stock trading chat room with live trade alerts. Trading strategy: Equities, Options, Technical, Day trader. If you. This is particularly the case when you talk about penny stocks and shorting (meaning, you make money when the price of a penny stock decreases). Many penny. Start live chat. yesno. message us; live chat. Penny Stocks. Penny stocks are traditionally defined as equity securities that trade below a market value of $5. Trading penny stocks. Are you considering penny stocks? Here is what you need to know. Fidelity Active Investor. Learn about the risks of penny stocks and speculative stock investments and how this market works Chat. Log In. studyplus.site · 中文登入 · Schwab International. They also use aliases on Internet bulletin boards and chat rooms to hide Some Common Penny Stock Fraud Schemes. Microcap fraud schemes can take a. Penny stocks are common shares of small public companies that trade for less than one dollar per share. The U.S. Securities and Exchange Commission (SEC). To close an OTC security position, please contact our trade desk via email at [email protected], chat, or phone. The $0 closing commission for stock.

Remitly Minimum Amount

Min Transfer Amount, $10 ; Sending Methods, Direct Debit (from the Bank Account)Debit CardCredit Card (Not recommended-Remittance often treated as cash advances). 2nd Best: Panda Remit · Cost /transfer: $ · Cheapest: 4% of Monito comparisons from the US to India in · Speed: In minutes · Pay-in options: Direct bank. Send money to India. Fees for when you send from USD to INR. Send Amount (USD), Fee. Below $1,, $ $1, or more, $0. Why choose Remitly? Guaranteed. money abroad with Revolut. You send. $1, US USD. $ Bank transfer fees. $Amount you'll convert. Exchange rate. Recipient gets. £ Minimum remittance is $ Maximum amount per daily transaction is $1, ² Most transfers are completed within 24 hours or less. Availability of funds in your. Complete a remit to India on the move, at a time that works for you. Save How do I estimate the cost to make a 'large amount' money transfer to India? New customers only. One per customer. Limited time offer. Discount promo requires a minimum spend of $50 USD. For promotion details, see Terms and Conditions. Maximum Sending limits - Remitly imposes daily, monthly, and day sending limits. These are based on where you and the recipient live. Low sending limits. $0 fees on your 1st transfer. Plus, get a $5 USD discount when you send $50 USD or more. Join millions of people who trust Remitly to send money home. Min Transfer Amount, $10 ; Sending Methods, Direct Debit (from the Bank Account)Debit CardCredit Card (Not recommended-Remittance often treated as cash advances). 2nd Best: Panda Remit · Cost /transfer: $ · Cheapest: 4% of Monito comparisons from the US to India in · Speed: In minutes · Pay-in options: Direct bank. Send money to India. Fees for when you send from USD to INR. Send Amount (USD), Fee. Below $1,, $ $1, or more, $0. Why choose Remitly? Guaranteed. money abroad with Revolut. You send. $1, US USD. $ Bank transfer fees. $Amount you'll convert. Exchange rate. Recipient gets. £ Minimum remittance is $ Maximum amount per daily transaction is $1, ² Most transfers are completed within 24 hours or less. Availability of funds in your. Complete a remit to India on the move, at a time that works for you. Save How do I estimate the cost to make a 'large amount' money transfer to India? New customers only. One per customer. Limited time offer. Discount promo requires a minimum spend of $50 USD. For promotion details, see Terms and Conditions. Maximum Sending limits - Remitly imposes daily, monthly, and day sending limits. These are based on where you and the recipient live. Low sending limits. $0 fees on your 1st transfer. Plus, get a $5 USD discount when you send $50 USD or more. Join millions of people who trust Remitly to send money home.

It often charges fixed fees around $4 for sending money, depending on the country, amount sent and payment method. Remitly's exchange rates. Instant transfers, diverse payment methods, lower transfer fees, wider reach. Remitly, No minimum / $2, for new users, up to $30, with verification. What do you dislike about Remitly? could not send a single transfer - no amount of verifying with customer protection team helped. Remitly User Agreement · Age and Capacity. You must be at least eighteen (18) years old to create an account, access, or use the Service as a Sender. · Charges. Get a special rate and no fees on your first transfer with Remitly. $0 fees for mobile money. Every time. Special rate. 1 USD = PHP. Get this rate. No minimum or maximum limits on fund transfer; Credit to beneficiary account within 48 hours; Easy to instruct for creating FCNR deposits. Mandatory. At that time, the going rate was 8 to 10% of the total transfer just to send the money. He realized that, with the help of technology, the cost of these kinds. remit to India It provides peace of mind while transferring large amount of funds from US. Secure 24/7 processing via Mashreq Mobile & Online · Instant or same day credits · No correspondent bank charges and no deductions made to the amount received. With Wise, you get the mid-market rate with zero FX mark-ups and zero hidden fee. Don't believe it? Just compare the exchange rate and the total amount received. Fee. USD ; Discount. USD ; Total cost. USD. Remitly User Agreement · Age and Capacity. You must be at least eighteen (18) years old to create an account, access, or use the Service as a Sender. · Charges. Reasons for Switching to Remitly: Remitly kept my money from a failed transaction Cons: should drop the minimum amount for free transfer from $ Switched. (2)Estimated solely for purposes of calculating the registration fee pursuant to Rule (a) of the Securities Act. (3)Of this amount, the Registrant previously. For an economy transfer sent from the US to the Philippines worth $, Remitly charges a minimum of $ if your recipient chooses to receive the money in USD. Transfer amount as low as $10 · Often best exchange rate for slow transfers · Instant transfer using debit card at little lower rate · No transfer fees above $ Get this rate. You send. US. USD. Or select an amount. $ $ $1, They receive. KE. KES. Special rate. 1 USD = KES. Fee. Zero fees. Total cost. Transfer Limit: The minimum transfer amount in Egyptian Pound is 2, and for USD is Maximum transfer amount will be as specified on the QIB Mobile App. To make the payment, you will need to access your online or mobile banking and transfer the total amount to Kabayan Remit's bank account's details below. When. Do you need to pay the conversion/transfer fee first before receiving the full amount? Or is that a scam?

Medal Of Honor Coin

Features · The coin is new in excellent condition · In modern times, challenge coins aren't just used by the Armed Forces; they are also used in business to. Medal of Honour community. skeleton-white. Medal of Honour news. About Medal of Honour. Most Visited Cryptocurrencies. BTC logo. Bitcoin. We offer our top-quality coins as a remembrance of the service and sacrifice our nation's Medal of Honor Recipients and all military veterans who have served to. Coin. What a wonderful way to teach your children or grandchildren about our armed forces and the service personnel who have earned this prestigious honor. Trusted expert on Commemorative Proof Silver Dollars. Buy US Commemorative Dollar Proof P Medal Of Honor online 24/7 with Golden Eagle Coins. Medal of Honor Commemorative Coin - U.S. Mint. Medal of Honor Challenge Coin Sea, Air and Land Teams new Anniversary. Description. They are a fantastic way to honor a valued member of your team. Law Enforcement coins have caught on as well, and nothing will reward the loyalty. Coins/Pins. Medal of Honor Park Challenge Coin. $ Add to cart. Coins/Pins. Medal of Honor Park Challenge Coin. $ Add to cart. Coins/Pins. Features · The coin is new in excellent condition · In modern times, challenge coins aren't just used by the Armed Forces; they are also used in business to. Medal of Honour community. skeleton-white. Medal of Honour news. About Medal of Honour. Most Visited Cryptocurrencies. BTC logo. Bitcoin. We offer our top-quality coins as a remembrance of the service and sacrifice our nation's Medal of Honor Recipients and all military veterans who have served to. Coin. What a wonderful way to teach your children or grandchildren about our armed forces and the service personnel who have earned this prestigious honor. Trusted expert on Commemorative Proof Silver Dollars. Buy US Commemorative Dollar Proof P Medal Of Honor online 24/7 with Golden Eagle Coins. Medal of Honor Commemorative Coin - U.S. Mint. Medal of Honor Challenge Coin Sea, Air and Land Teams new Anniversary. Description. They are a fantastic way to honor a valued member of your team. Law Enforcement coins have caught on as well, and nothing will reward the loyalty. Coins/Pins. Medal of Honor Park Challenge Coin. $ Add to cart. Coins/Pins. Medal of Honor Park Challenge Coin. $ Add to cart. Coins/Pins.

S Medal of Honor, $1 Silver Commemorative Uncirculated Coin in OGP with COA.

What is the name of the Medal? · Why are they called Recipients and not Winners? · Are most Medals of Honor are awarded posthumously? · Are the Unknown Soldiers. We cannot stress enough our gratitude for your support in helping the White House Gift Shop serve those who serve America with honor, bravery, distinction, and. Obverse: The obverse of the coin displays the three different Medals of Honor currently being used by the Army, Navy and the Air Force. The obverse has the. CONGRESSIONAL MEDAL OF HONOR SOCIETY COIN 2 RARE · ChiefMart. CONGRESSIONAL MEDAL OF HONOR SOCIETY COIN 2 RARE. (No reviews yet) Write a Review. Write a Review. Created to commemorate our nation's highest honor for valor, and to teach the definition of a veteran, the National Foundation of Patriotism minted this coin. The design on the obverse of this proof $5 Gold coin depicts the original Medal of Honor authorized by Congress in as the Navy's highest personal. Custom Honor Coins are an outstanding way to recognize service and commitment for both military personnel and civilians. Design your own or reproduce an. Medal Of Honor Coin: All Gave Some, Some Gave All Medal of Honor Coin honoring the WWII Submarines Stil on Patrol. Medal Of Honor Coin. $ Item. This challenge coin honors Delano Morey from Hardin County Ohio who recieved the Medal of Honor during the American Civil War. The front of the coin depicts. Bluebook · Public Law - 91 - Medal of Honor Commemorative Coin Act of · Category · Collection · SuDoc Class Number · Law Number · Date Approved · Full. The coin measures 2 1/4" and beautifully displays the values of the Medal of Honor and an image of the soon-to-be-constructed Museum located in Arlington, Texas. This coin was awarded by Specialist John P. Baca, Medal of Honor (MoH) Recipient. When a fragmentation grenade was tossed into their midst. The Congressional Medal of Honor Foundation raises funds to support the programs of the Congressional Medal of Honor Society. Join us by supporting the. The $1 Silver Medal of Honor Commemorative Coin was created by the United States Mint in gratitude for the soldiers who have severs and been awarded the. First Medal of Honor Recipient Jacob Parrott Challenge Coin This challenge coin honors the first Medal of Honor recipient Jacob Parrott. The front of the coin. This coin was awarded by Sergeant First Class Leroy Petry, Medal of Honor (MoH) Recipient. Awarded to John P. Baca, Vietnam, 10 Feb. by the Congressional Medal of Honor Society. Date: Country (if not USA). studyplus.site: Medal of Honor US Challenge Coin Commemorative Medal Gift Metal Crafts Award Cross Border, Colorful: Collectibles & Fine Art. Summary of H.R - th Congress (): Medal of Honor Commemorative Coin Act of Medal of Honor coin – years in the making Medal of Honor coin – years in the making. It happened nearly years ago, during WWI, at a battle between.

What Happens If You Dont File Taxes On Time

If you owe the IRS money, filing your tax return late (or never) can cost you penalties and interest. If the return is filed late with net tax due, both the late filing and late payment penalties will be assessed at the same time. “Net tax due” is the amount of. If you have a balance due, the IRS can assess a late filing penalty and a late payment penalty. The IRS charges interest on unpaid tax from the late tax. An account becomes delinquent when the due date for a tax return or other established liability has passed and the amount due remains unpaid. What Happens If I Don't File Taxes? · You can incur failure-to-file penalties. · Interest will be assessed on your balance. · You may face liens, levies. At its most extreme, your failure to file penalty can total 25 percent of your unpaid taxes. What Happens If You Don't Pay Taxes You Owe? The answer really. If you don't file your taxes on time but don't owe money, you won't face penalties. However, you may delay or miss out on a potential refund. You didn't intend. Key takeaways · Whether you have to file a tax return depends on your gross income, filing status, age, and dependent status. · You may only face a penalty if you. When IRS penalties apply: If you owe taxes and do not file a tax return or extension on time, you will incur a late filing penalty and/or late tax payment. If you owe the IRS money, filing your tax return late (or never) can cost you penalties and interest. If the return is filed late with net tax due, both the late filing and late payment penalties will be assessed at the same time. “Net tax due” is the amount of. If you have a balance due, the IRS can assess a late filing penalty and a late payment penalty. The IRS charges interest on unpaid tax from the late tax. An account becomes delinquent when the due date for a tax return or other established liability has passed and the amount due remains unpaid. What Happens If I Don't File Taxes? · You can incur failure-to-file penalties. · Interest will be assessed on your balance. · You may face liens, levies. At its most extreme, your failure to file penalty can total 25 percent of your unpaid taxes. What Happens If You Don't Pay Taxes You Owe? The answer really. If you don't file your taxes on time but don't owe money, you won't face penalties. However, you may delay or miss out on a potential refund. You didn't intend. Key takeaways · Whether you have to file a tax return depends on your gross income, filing status, age, and dependent status. · You may only face a penalty if you. When IRS penalties apply: If you owe taxes and do not file a tax return or extension on time, you will incur a late filing penalty and/or late tax payment.

“Not filing a tax return can create a penalty of 5% per month, up to 25%. This is based on the tax due,” Armstrong says. “The penalty for not paying or paying. If you are owed a federal refund and you are late filing your taxes, there is no penalty. You have up to three years after the April due date to. If you don't pay your tax balance by the original filing due date, you must pay interest on your unpaid taxes. Interest starts accruing the day after the. If you are not sure that you lived in a taxing school district during the time you lived at each address provided. AND. •. Additional documentation. The penalty for not filing your return is typically 5% of the tax you owe for each month or partial month your return is late. You may have to pay a penalty for not filing your return by the due date, not paying tax due on time, not pre-paying enough on an extension return, and not. Late Filing - Two (2) percent of the total tax due for each 30 days or fraction thereof that a tax return or report is late. The maximum penalty is 20 percent. Under the Code, the IRS may imprison you for up to 5 years, with a maximum fine of $, What happens if you just don't file for taxes? If you haven't. For failure to file a return on time, a penalty of 5 percent of the tax accrues if the delay in filing is not more than 30 days. An additional 5 percent penalty. What happens if you file taxes late? · If you're owed a tax refund, you could miss out on receiving that money if you don't file. · If you owe tax money to the. If you don't file, you can lose your refund. If you owe tax, the IRS adds penalties and interest. You may also face liens, levies, and other financial. The more likely outcome would be the IRS charges you with a failure to file and failure to pay, which carries a penalty of 5% based on the time from the. The answer is yes. You won't receive a tax refund if you don't file taxes. Even worse, you can lose your chance to get a refund. Late Payment Penalty. If you file your return within 6 months after the due date but do not pay the tax due until after that time, your return will be. What happens if I don't pay on time? · Levy your property, bank account, salary or wages · Lien your property · Revoke (suspend) your seller's permit. · Revoke . The IRS is so serious about late filing that the penalty for doing so is much higher (5% of unpaid taxes for every month you delay up to a 25% cap) than the. I don't file my Wisconsin income tax return by the due date? Will I be assessed a late filing fee if I qualify for an extension of time to file? What is the. What happens if you file taxes late? · If you're owed a tax refund, you could miss out on receiving that money if you don't file. · If you owe tax money to the. What happens if I don't file my tax report? If you fail to file a required tax report, the Comptroller's office will send you an estimated billing with. An account becomes delinquent when the due date for a tax return or other established liability has passed and the amount due remains unpaid.

Rate Of Exchange Dollar To Euro

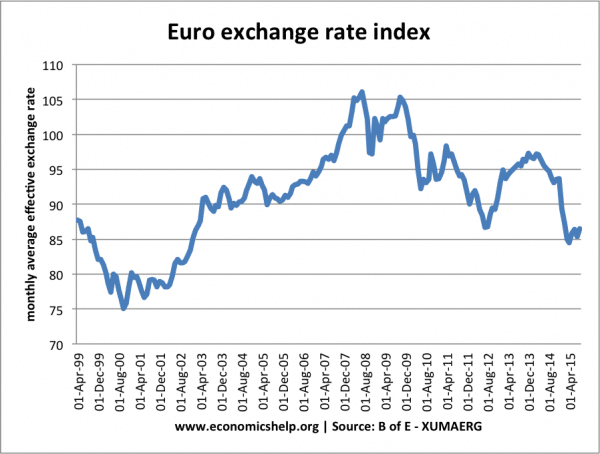

The exchange rate for US dollar to Euros is currently today, reflecting a % change since yesterday. Over the past week, the value of US dollar has. So if it costs a U.S. dollar holder $ to buy one euro, from a euroholder's perspective the nominal rate is euros per dollar. But the nominal. 1 USD = EUR Sep 03, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. Get access to 20+ years of US dollar to euro exchange rates, broken down by daily, monthly & yearly periods. US Dollars to Euro Spot Exchange Rate (EXUSEU) Jul | US Dollars to One Euro | Monthly | Updated: Aug 5, PM CDT. Operational exchange rates for one United States Dollar (USD) listed by country. Euro, , 01 Sep , History. Angola, AOA, Angolan Kwanza, , USD = EUR. Sep 03, UTC. 1. Configure Converter. amount ▻. ↔. ▻Currency Calculator▻; ▻Graphs▻; ▻Rates Table▻. Current exchange rate EURO (EUR) to US DOLLAR (USD) including currency converter, buying & selling rate and historical conversion chart. Convert your USD or EURO money into foreign currencies · 1 USD · EUR. The exchange rate for US dollar to Euros is currently today, reflecting a % change since yesterday. Over the past week, the value of US dollar has. So if it costs a U.S. dollar holder $ to buy one euro, from a euroholder's perspective the nominal rate is euros per dollar. But the nominal. 1 USD = EUR Sep 03, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. Get access to 20+ years of US dollar to euro exchange rates, broken down by daily, monthly & yearly periods. US Dollars to Euro Spot Exchange Rate (EXUSEU) Jul | US Dollars to One Euro | Monthly | Updated: Aug 5, PM CDT. Operational exchange rates for one United States Dollar (USD) listed by country. Euro, , 01 Sep , History. Angola, AOA, Angolan Kwanza, , USD = EUR. Sep 03, UTC. 1. Configure Converter. amount ▻. ↔. ▻Currency Calculator▻; ▻Graphs▻; ▻Rates Table▻. Current exchange rate EURO (EUR) to US DOLLAR (USD) including currency converter, buying & selling rate and historical conversion chart. Convert your USD or EURO money into foreign currencies · 1 USD · EUR.

That's why we provide comprehensive currency exchange services to get you the cash you need at a reasonable rate Nearly ATM locations dispense U.S. Dollar. Check the currency rates against all the world currencies here. The currency converter below is easy to use and the currency rates are updated frequently. Also, get the latest news that could affect currency exchange rates USD/JPY Forecast – US Dollar Continues to Build a Potential Base Against The Yen. You must express the amounts you report on your U.S. tax return in U.S. dollars. If you receive all or part of your income or pay some or all of your. US dollar (USD). ECB euro reference exchange rate. 3 September EUR 1 = USD (%). Change from 4 September to 3 September Min (3. US Dollars to Euros conversion rates ; 1 EUR, USD ; 5 EUR, USD ; 10 EUR, USD ; 25 EUR, USD. Market Exchange Rates Table ; 1 USD, 1, , , ; 1 EUR, , 1, , OANDA's Currency Converter allows you to check the latest foreign exchange average bid/ask rates and convert all major world currencies. Our Dollar to Euro conversion tool gives you a way to compare the latest and historic interbank exchange rates for USD to EUR · Currency Menu. Quickly and easily calculate foreign exchange rates with this free currency converter. From. United States - USD. Check today's US Dollar to Euro exchange rate with Western Union's currency converter. Send USD and your receiver will get EUR in minutes. %. (1Y). US Dollar to Euro. 1 USD = EUR. Sep 3. Popular CurrenciesCollapse ; EUROZONE, EURO (EUR) 1 EUR = USD ; GREAT BRITAIN, POUND (GBP) 1 GBP = USD ; HONG KONG, DOLLAR (HKD) 1 HKD = USD. Euro Zone, Euro, , , ; Hong Kong, Dollar, , , In depth view into US Dollar to Euro Exchange Rate including historical data from to , charts and stats. US Dollars to Euros conversion rates ; 1 EUR, USD ; 5 EUR, USD ; 10 EUR, USD ; 25 EUR, USD. Consult the daily exchange rate of the dollar to the euro and its historical evolution. Enter BBVA. Where to Get the Best Exchange Rate for Dollars to Euros MoneyGram and Wise have fought for the top spot as the cheapest money transfer providers from the US. The EURUSD decreased or % to on Tuesday September 3 from in the previous trading session. Euro US Dollar Exchange Rate - EUR/USD. 3 September All currencies quoted against the euro (base currency). Currency, Spot, Chart. USD · US dollar · · USD · JPY · Japanese yen ·

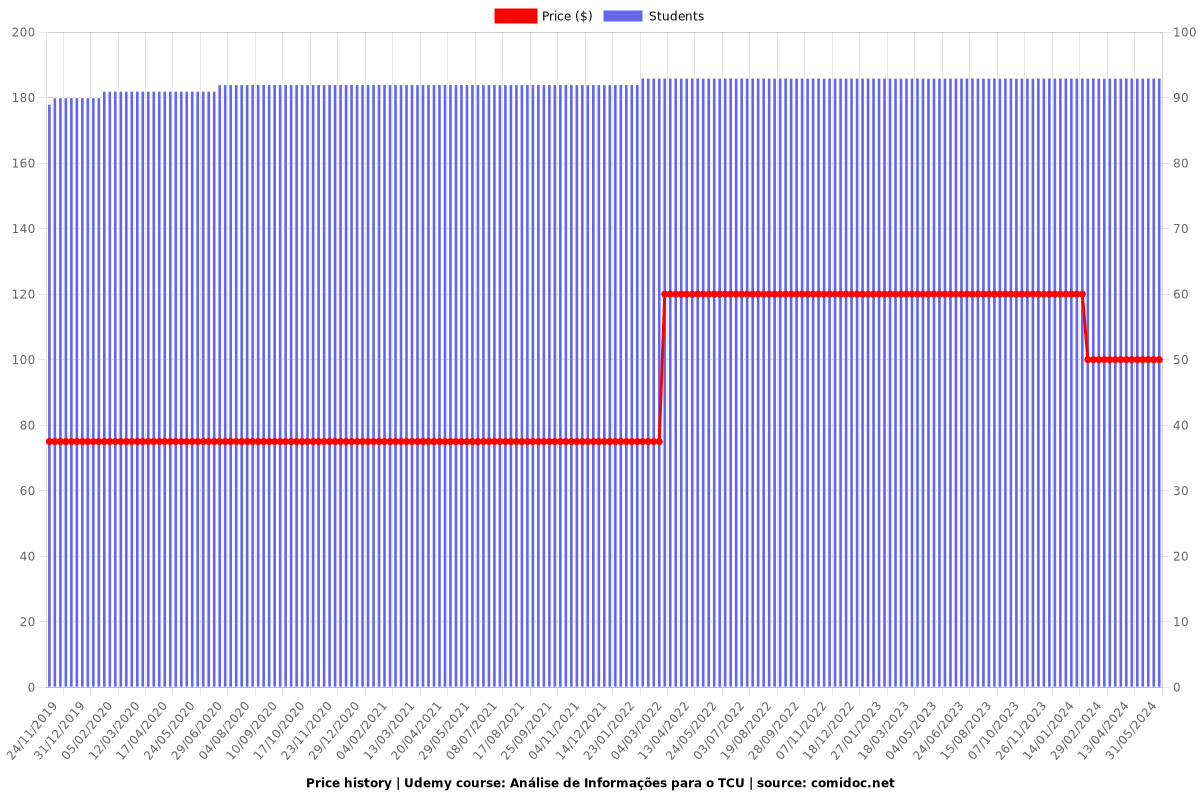

Tcu Price

Total Cost of Attendance. Established in , Texas Christian University (TCU) frequently makes the lists for the top universities in the nation. TCU tuition. Find everything you need to know about Texas Christian University (TCU), including tuition & financial aid, student life, application info. The Price Is Right Live™ is the hit interactive stage show that gives eligible individuals the chance to hear their names called and "Come On Down" to win. The details: % Preshrunk Cotton- Meaningfully Distressed, each piece unique- Regular price: $ Regular price: Sale price: $ Unit price: /. Texas Christian University (). studyplus.site In Texas Christian University () had an average net price — the price paid after factoring in. The total Texas Christian University costs may not be what you expected. College Factual estimates what your net price may be to attend TCU by subtracting. Admission is free for any children under 2 years of age, so long as they do not occupy a seat. There may be an exception to this for children's shows where the. How Much Does TCU Charge for Tuition? Combined tuition and fees at Texas Christian University for the academic year was $51, for undergraduates. Below we've mapped out the tuition, fees, and room and board that will help you understand how much you will pay for Texas Christian University | TCU. Total Cost of Attendance. Established in , Texas Christian University (TCU) frequently makes the lists for the top universities in the nation. TCU tuition. Find everything you need to know about Texas Christian University (TCU), including tuition & financial aid, student life, application info. The Price Is Right Live™ is the hit interactive stage show that gives eligible individuals the chance to hear their names called and "Come On Down" to win. The details: % Preshrunk Cotton- Meaningfully Distressed, each piece unique- Regular price: $ Regular price: Sale price: $ Unit price: /. Texas Christian University (). studyplus.site In Texas Christian University () had an average net price — the price paid after factoring in. The total Texas Christian University costs may not be what you expected. College Factual estimates what your net price may be to attend TCU by subtracting. Admission is free for any children under 2 years of age, so long as they do not occupy a seat. There may be an exception to this for children's shows where the. How Much Does TCU Charge for Tuition? Combined tuition and fees at Texas Christian University for the academic year was $51, for undergraduates. Below we've mapped out the tuition, fees, and room and board that will help you understand how much you will pay for Texas Christian University | TCU.

Discover TCU Polyurethane Coil Tubing at Proax - Canada's top automation distributor. Easy TUBING, POLYURETHANE, COIL TUBE 5PC/BOX PRICE EA PC. 11 In. Texas Christian University (TCU) Collegiate Embroidered Pillow. Regular price: Sold Out | $ Sale price: $ Regular price. Unit price: /per. Sale. 2X · The TCU Glitter Script Short Sleeve. Regular Price: from $ Sale Price: from $; Regular Price. Unit Price: /per. Added to Bag. Texas Christian University's (TCU) Board of Trustees approved differential tuition for the Neeley School of Business to take effect in Fall Semester of Keep in mind that the total cost to attend TCU for four years is north of $k per kid so keep that in mind as well as whatever their future. I will be the first to admit that TCU is expensive, and tuition is going to increase next year. However, they give out a huge amount of scholarships and. The details: % Preshrunk Cotton- Meaningfully Distressed, each piece unique- Regular price: $ Regular price: Sale price: $ Unit price: /. Cost of Attendance · Admissions · Estimated Cost of Attendance · MS1, Class of · MS2, Class of · MS3, Class of · MS4, Class of · Other. I would consider myself a low income transfer student. But I know a lot of people will say to stay away from TCU because the price isn't. The Tuition of Texas Christian University (TCU) is $ for undergraduate programs and $ for graduate programs. Come On Down for this hit interactive stage show that gives you the chance to play the world's longest running gameshow live on stage! Below we've mapped out the tuition, fees, and room and board that will help you understand how much you will pay for Texas Christian University | TCU. The free Net Price Calculator provides an early approximation of what a new first-year, undergraduate student can expect to pay to attend TCU. Quantity Pricing The TCU series is a polyurethane coil tubing that is very flexible and makes compact piping possible. The TCU series comes in three different. Collection: TCU. For all of you Horned Frogs Sort by. Featured, Best selling, Alphabetically, A-Z, Alphabetically, Z-A, Price, low to high. Tyree Price joined the Horned Frog staff an assistant coach (jumps) for the TCU track and field programs in the Summer of Named the USTFCCCA Women's. The average annual cost for students at Texas Christian University (TCU) is $ The dictionary definition of average annual cost covers expenses like. TCU's tuition for the academic year is $57,, which is higher than the national average for four-year private nonprofit institutions. In addition. Hudson Price (21) G - | SOPHOMORE SEASON · Academic All-Big 12 Second Team Price played in 28 games during his sophomore season. Home > Graduate Programs > MBA > EMBA > Tuition and Scholarships. Class of Tuition and Payment Schedule. The TCU Executive MBA Program tuition and fees.

Apps For Tracking Money Spending

![]()

A monthly expense tracker app automates the process of recording transactions, totaling expenses by category and tracking progress toward goals. The best money tracker appNavigate your finances with confidence. Track spending. Dive into in-depth reports on your spending and cash flow to help you effectively manage your money. Wallet allows you to see your finances your way: anywhere. Free multi-award-winning budgeting and money management app. Snoop works 24/7, tracking your spending and finding smart ways to save on your bills. Weekly is a beautiful budget app based on a week. Plan your budget, track your spending and save for your goals. Syncs with your bank. You Need a Budget is a strong choice if you want to use a detailed and hands-on budgeting app to monitor expenses. The app Spending Tracker is super simple. Super simple, gives you most of the standard metrics you need. Have the option to export your data as a CSV. Best Budgeting Apps For Families In · EveryDollar utilizes zero-based budgeting for easy-to-use budget tracking through the free mobile app. · PocketGuard. EveryDollar is a straightforward, easy-to-use budgeting app that allows users to create a customizable budget and set savings goals. Users can opt to upgrade to. A monthly expense tracker app automates the process of recording transactions, totaling expenses by category and tracking progress toward goals. The best money tracker appNavigate your finances with confidence. Track spending. Dive into in-depth reports on your spending and cash flow to help you effectively manage your money. Wallet allows you to see your finances your way: anywhere. Free multi-award-winning budgeting and money management app. Snoop works 24/7, tracking your spending and finding smart ways to save on your bills. Weekly is a beautiful budget app based on a week. Plan your budget, track your spending and save for your goals. Syncs with your bank. You Need a Budget is a strong choice if you want to use a detailed and hands-on budgeting app to monitor expenses. The app Spending Tracker is super simple. Super simple, gives you most of the standard metrics you need. Have the option to export your data as a CSV. Best Budgeting Apps For Families In · EveryDollar utilizes zero-based budgeting for easy-to-use budget tracking through the free mobile app. · PocketGuard. EveryDollar is a straightforward, easy-to-use budgeting app that allows users to create a customizable budget and set savings goals. Users can opt to upgrade to.

Spending Tracker is the easiest and most user friendly Personal Finance App in the store. And best of all, it's free! The simple fact is, by tracking your. And with iCloud, it's easy to keep all your expenses in sync across your devices and collaborate with others using sharing. The apps are available on Mac. To help you streamline your financial life and make budgeting a breeze, we've reviewed six of the top budgeting apps in the market. Clockify lets you track and record your employees' expenses such as hours, mileage, days, or overtime pay with a free expense tracker. business expense app. How. Now easily record your personal and business financial transactions, generate spending reports, review your daily, weekly and monthly financial data and manage. Easy Expense - Best mobile expense tracker app overall · QuickBooks Online & QuickBooks Self-Employed - Best for small businesses and self-employed tax filers. Pros: Money Manager simplifies expense management with intuitive expense tracking, budgeting tools, and insightful financial reports. It. Mint is one of the best expense-tracker apps for personal finance tools, and it's a great option for microbusinesses or side hustles. Mint is free, supports a. MoneyPatrol offers a gamut of features and functions for effective and successful money management. The application is designed specifically to help you focus. Moneyhub Moneyhub is a comprehensive but simple to use budgeting app which provides one of the most accurate evaluations of your net worth. Unlike other apps. We chose QuickBooks Accounting as the best expense tracking app for small businesses because users can send and track invoices and automatically track mileage. Goodbudget is a budget tracker for the modern age. Say no more to carrying paper envelopes. This virtual budget program keeps you on track with family and. Take charge of your finances with Mint's online budget planner. Our free budget tracker helps you understand your spending for a brighter financial future. Track expenses & make budgets for free with the easiest expense app by Bookipi. Split work or small business vs personal expenses in one spot. Need a replacement for Mint? Make sense of your budget, get a grasp on your household spending, or check your credit score with the best apps we've tested. Best for overspenders: PocketGuard aims to help people easily understand how much money can be spent within their budget each month. Manage all your money with ease from one place with Spendee. Track your income and expenses, analyze your financial habits and stick to your budgets. Budgeting apps are software applications you can access from most personal devices to manage your personal finances. Spending Tracker is the easiest and most user friendly Personal Finance App in the store. And best of all, it's free! Money Lover keeps is a simple app that allows you to track and categorise your spending and incoming money.