studyplus.site Overview

Overview

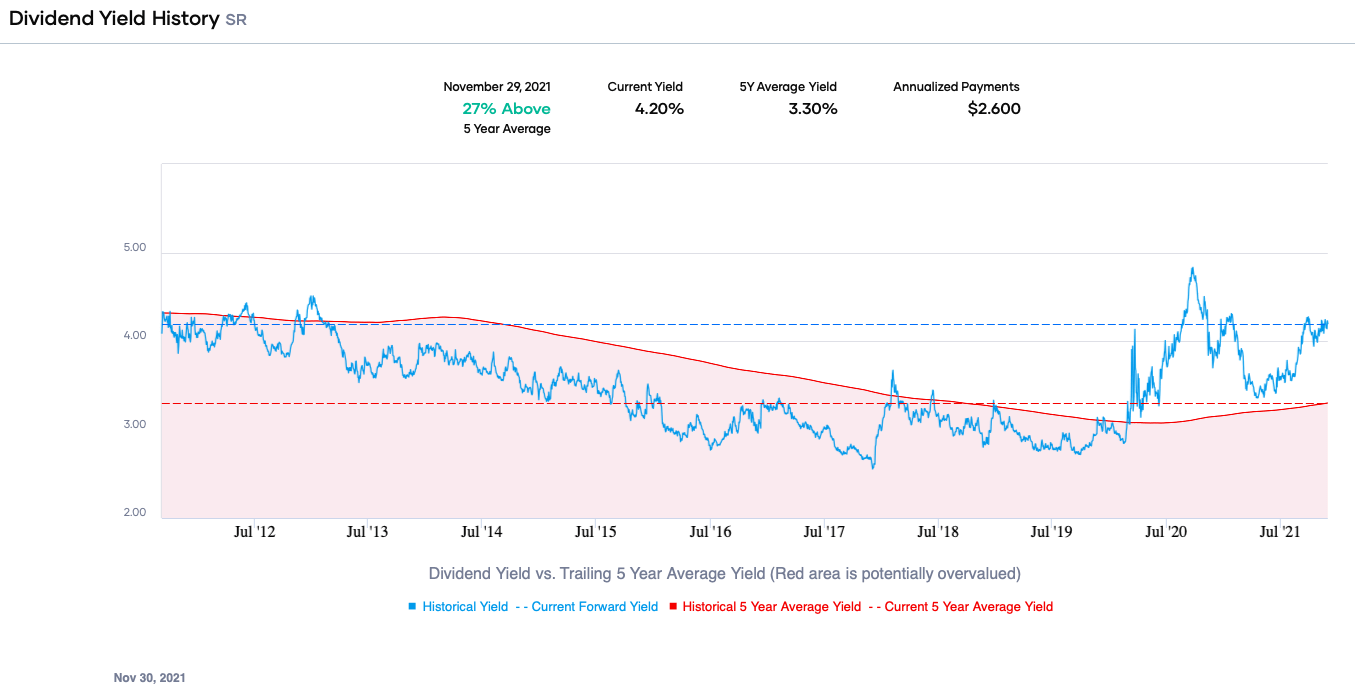

Spire Stocks

Spire Inc has % upside potential, based on the analysts' average price target. Spire Inc has a consensus rating of Hold which is based on 0 buy ratings, 6. Vol. Vol. Vol. Trending Stocks Vol. On Friday, Spire (NYSE:SR) Global (NYSE:SPIR), a provider of space-based data and analytics, had its price target. NYSE: SR ; Volume. , ; Day high. ; 52 week high. ; Market cap. $B ; Day low. Spire is a global provider of space-based data and analytics that offers unique datasets and powerful insights about Earth from the ultimate vantage point. Stock analysis for Spire Global Inc (SPIR:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Dividend Reinvestment Plan. Spire offers a Dividend Reinvestment and Direct Stock Purchase Plan, which provides a convenient way for potential investors to. Complete Spire Inc. stock information by Barron's. View real-time SR stock price and news, along with industry-best analysis. View live Spire Global, Inc. chart to track its stock's price action. Find market predictions, SPIR financials and market news. Discover real-time Spire Inc. Common Stock (SR) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Spire Inc has % upside potential, based on the analysts' average price target. Spire Inc has a consensus rating of Hold which is based on 0 buy ratings, 6. Vol. Vol. Vol. Trending Stocks Vol. On Friday, Spire (NYSE:SR) Global (NYSE:SPIR), a provider of space-based data and analytics, had its price target. NYSE: SR ; Volume. , ; Day high. ; 52 week high. ; Market cap. $B ; Day low. Spire is a global provider of space-based data and analytics that offers unique datasets and powerful insights about Earth from the ultimate vantage point. Stock analysis for Spire Global Inc (SPIR:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Dividend Reinvestment Plan. Spire offers a Dividend Reinvestment and Direct Stock Purchase Plan, which provides a convenient way for potential investors to. Complete Spire Inc. stock information by Barron's. View real-time SR stock price and news, along with industry-best analysis. View live Spire Global, Inc. chart to track its stock's price action. Find market predictions, SPIR financials and market news. Discover real-time Spire Inc. Common Stock (SR) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions.

Stock analysis for Spire Inc (SR:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Research Spire's (NYSE:SR) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. (NYSE: SR) Spire currently has 57,, outstanding shares. With Spire stock trading at $ per share, the total value of Spire stock (market. Spire Global Inc stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Stocks: Most Actives · Stocks: Gainers · Stocks: Losers · Trending Tickers · Futures Spire Global, Inc. (SPIR). Follow. Compare. + (+%). At close. See charts, data and financials for Spire Inc. SR. Complete Spire Global Inc. stock information by Barron's. View real-time SPIR stock price and news, along with industry-best analysis. Get Spire Global Inc (SPIR:NYSE) real-time stock quotes, news, price and financial information from CNBC. Spire Global, Inc. (studyplus.site): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Spire Global, Inc. | Nyse: SPIR | Nyse. Our gas-related businesses include Spire Marketing and Spire Midstream. End of Day Stock Quote. Captcha. Enter the code shown above. *. Submit. Sign up. Get Spire Inc (SR:NYSE) real-time stock quotes, news, price and financial information from CNBC. Spire Inc has % upside potential, based on the analysts' average price target. Spire Inc has a consensus rating of Hold which is based on 0 buy ratings, 6. See the latest Spire Inc stock price (SR:XNYS), related news, valuation, dividends and more to help you make your investing decisions. View Spire Inc SR investment & stock information. Get the latest Spire Inc SR detailed stock quotes, stock data, Real-Time ECN, charts, stats and more. News & Analysis · Why Spire Global Stock Just Rocketed to the Moon · Spire Global Is Speeding Up, Not Slowing Down · Why Spire Stock Rocketed Last Night · Why. SPIR | Complete Spire Global Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Spire Global, Inc. is a space-to-cloud data and analytics company that specializes in the tracking of global data sets powered by a large constellation of. Spire Inc.'s stock symbol is SR and currently trades under NYSE. It's current price per share is approximately $ What. Where is Spire's common stock listed? Our common stock is listed on NYSE under the symbol SR. For more detailed stock information, please visit our Stock. View live Spire Inc. chart to track its stock's price action. Find market predictions, SR financials and market news.

Vwap Formula

:max_bytes(150000):strip_icc()/vwapformula-5c3fc63c46e0fb000106f994.jpg)

VWAP & Moving VWAP. VWAP is an acronym for Volume-Weighted Average Price, the ratio of the value traded to total volume traded over a particular time horizon . The calculation uses both the number of seconds into the session, along with a percentage of current VWAP, to build the band multiples. This is a nice. VWAP is a technical analysis indicator used by traders to determine the average price of a stock over a certain period of time. Come review the indicator formula write up for Volume Weighted Average Price (VWAP). In finance, volume-weighted average price (VWAP) is the ratio of the value of a security or financial asset traded to the total volume of transactions. How to Calculate VWAP. The VWAP calculation involves taking the average of the products of the number of shares traded (volume) and the share price (value). The Volume Weighted Average Price (VWAP) is the average price throughout the day, adjusted for volume of shares traded. calculation. However, VWAP is typically used within one trading day and uses a one minute time frame. The formula for VWAP is: VWAPformula. The price can be. How to use The Volume Weighted Average Price (VWAP) Technical Indicator formula included with the Excel Price Feed Add-in. VWAP & Moving VWAP. VWAP is an acronym for Volume-Weighted Average Price, the ratio of the value traded to total volume traded over a particular time horizon . The calculation uses both the number of seconds into the session, along with a percentage of current VWAP, to build the band multiples. This is a nice. VWAP is a technical analysis indicator used by traders to determine the average price of a stock over a certain period of time. Come review the indicator formula write up for Volume Weighted Average Price (VWAP). In finance, volume-weighted average price (VWAP) is the ratio of the value of a security or financial asset traded to the total volume of transactions. How to Calculate VWAP. The VWAP calculation involves taking the average of the products of the number of shares traded (volume) and the share price (value). The Volume Weighted Average Price (VWAP) is the average price throughout the day, adjusted for volume of shares traded. calculation. However, VWAP is typically used within one trading day and uses a one minute time frame. The formula for VWAP is: VWAPformula. The price can be. How to use The Volume Weighted Average Price (VWAP) Technical Indicator formula included with the Excel Price Feed Add-in.

The formula for calculating VWAP equals the typical price (the average of the low price, the high price, and the closing price of the stock for a given day). VWAP equals the dollar value of all trades during a day divided by the total trading volume for the day. The calculation starts when trading opens and ends when. VWAP is the volume-weighted average price for a futures contract plotted as a line on the price chart. The calculation is the sum of traded volume, multiplied. Volume-Weighted Average Price (VWAP) is a trading algorithm based on a pre VWAP as an Indicator and Its Formula. The schedule is the heart of a. How to use The Volume Weighted Average Price (VWAP) Technical Indicator formula included with the Excel Price Feed Add-in. How to use The Volume Weighted Average Price (VWAP) Technical Indicator formula included with the Excel Price Feed Add-in. The Volume-Weighted Average Price (VWAP) is calculated using the following formula: where sizei is the volume traded at pricei. The VWAP plot is accompanied. The descriptions, formulas, and parameters shown below apply to both Interactive Charts and Snapshot Charts, unless noted. Please note that some of the. The VWAP calculation will give you a volume weighted average price for the specified time period. A VWAP is different to a simple moving average that would sum. Calculating Volume-weighted Average Price (VWAP) The calculation begins with the Typical Price (TP) price of the first completed bar or candle on the chart. VWAP as an indicator throughout the day. VWAP Formula Calculations. Why Is VWAP Used? For intraday traders, the VWAP is often used as a trend indicator. For. There are five steps in calculating VWAP: Calculate the Typical Price for the period. Multiply the Typical Price by the period Volume. Create a Cumulative. This calculation would produce a single value that represents the average price paid for the asset throughout the day, weighted by the volume of trades. In finance, volume-weighted average price (VWAP) is the ratio of the value of a security or financial asset traded to the total volume of transactions. Vi is the corresponding trading volume at each data point. Let's implement this calculation: # Calculate VWAP data['VWAP'] = (((data['High. The formula is simply a matter of dividing total dollar volume by total share volume. VWAP Calculation. The VWAP is often seen as a benchmark price to gauge. In his article, "VWAP for Support and Resistance", George Reyna explains how to calculate the volume weighted average price, or VWAP Formula: sm:=Input(". EasyLanguage expression to use in calculating the VWAP value. Length. Numeric, 20, Number of bars used in calculation of the deviations bands. NumDevsUp. VWAP Indicator Calculation & Formula; How to Use VWAP; VWAP vs. MVWAP; Anchored VWAP; VWAP indicator for MT4; Limitations of Using VWAP; Pros and Cons.

How To Do Secret Shopping

Once registered, take your pick from a variety of mystery shopping opportunities in your neighborhood, over the phone, or online. We even offer mystery shops. Mystery Shopping is a well-known method of customer research. Leverage BARE International's 35+ years of experience that has taken this tried and true method. With mystery shopping companies it is as simple as logging into an app and seeing what is around you. Zero sign up fee, zero commitment, pick up. Experience the best in mystery shopping with BestMark! Our company offers top-notch services for all your mystery shopping needs. Contact us today for more. Our mystery shops and resident surveys deliver the objective, in-depth data you need to understand your on-site team's performance. It is VERY important that you review the guidelines in full first, BEFORE making your application./ Secret Shopper assignment does vary, depending on what is. Get paid to shop. Or eat. Or play. Become a mystery shopper for Market Force and get reimbursed for doing something you enjoy! They are usually local people hired via a contract with a mystery shopper business. At times, their own hiring ads say “get paid to shop” in. How much do I get paid? · Each shopping assignment has different client payments. · Client payments range from $15 for basic shops and into the hundreds for more. Once registered, take your pick from a variety of mystery shopping opportunities in your neighborhood, over the phone, or online. We even offer mystery shops. Mystery Shopping is a well-known method of customer research. Leverage BARE International's 35+ years of experience that has taken this tried and true method. With mystery shopping companies it is as simple as logging into an app and seeing what is around you. Zero sign up fee, zero commitment, pick up. Experience the best in mystery shopping with BestMark! Our company offers top-notch services for all your mystery shopping needs. Contact us today for more. Our mystery shops and resident surveys deliver the objective, in-depth data you need to understand your on-site team's performance. It is VERY important that you review the guidelines in full first, BEFORE making your application./ Secret Shopper assignment does vary, depending on what is. Get paid to shop. Or eat. Or play. Become a mystery shopper for Market Force and get reimbursed for doing something you enjoy! They are usually local people hired via a contract with a mystery shopper business. At times, their own hiring ads say “get paid to shop” in. How much do I get paid? · Each shopping assignment has different client payments. · Client payments range from $15 for basic shops and into the hundreds for more.

Although some companies do hire “secret shopper services” to analyze their customer service by having “secret shoppers” buy certain goods or services at. iSecretShop is the first, fully-integrated mobile mystery shopping solution on the market. Using our mobile tools, shoppers can do literally everything. SASSIE's various technologies help us to win tenders. Their manager account levels make it easier to manage data and their testing system helps us do things. Mystery shopping plays an enlightening role in helping to improve marketing, enhance a facility's reputation, improve systems, and keep staff on their toes. You can apply with individual companies directly via their website. The process is quite simple & doesn't take long at all. The one thing I. Mystery shoppers typically mirror common consumer behaviors to test the consistency of the habits deemed important to a specific brand or industry. Mystery. How to Protect Yourself. Don't open or respond to unsolicited emails asking you to become a mystery shopper or secret shopper. Never deposit a check. It can be used for market research and customer satisfaction surveys. · Companies can get an understanding of their staff performance with mystery shopping. Mystery shopping is a technique that involves the use of trained individuals, known as “mystery shoppers”, to experience and measure key phases of a product's. Get Paid to Shop. Eat. Play. Earn income and get free stuff when you mystery shop your favorite stores, restaurants, and businesses. A mystery shopper is a self-employed evaluator, who seeks to be informed about opportunities to perform projects for third-party clients. Benefits to becoming a. Generally, payment will be between $8 and $25 per shop, but it may sometimes even be up to $ If required to make a purchase you will also receive a payment. Only scammers make these guarantees. And only scammers say that you'll be able to quit your job and do this full-time. Mystery shopping jobs are typically part-. Do you want to become an Ipsos Mystery Shopper? Register on iShopFor Ipsos and earn extra money by conducting Mystery Shopping tasks all around UK. A Mystery Shopper is a person who poses as a real customer whilst assessing the customer service provided by a company or organisation. What Makes a Successful Mystery Shopper? · Enjoy interacting with people. · Have excellent observation skills. · Are capable of remembering small details. · Have. We are experts at every step of the customer journey, providing data-driven insights through tactics such as mystery shopping, real-time feedback, market. Find a Mission Near You Mobee shows you available secret shopper missions in your area. Head to the location to begin shopping. I can do mystery shopping. Mystery shoppers, who work on a contract basis, secretly evaluate consumer-service companies by posing as ordinary customers. Getting Started With Mystery Shopping When you click the "Sign Up to Become a Mystery Shopper" link below, a new site will open in a new tab. Follow the.

Which Is Better To Invest Etf Or Mutual Fund

Generally, holding an ETF in a taxable account will generate less tax liabilities than if you held a similarly structured mutual fund in the same account. From. Since ETFs are passively managed, they tend to be lower cost than mutual funds that are more actively managed. Exchange-traded funds, or ETFs, are pooled. You can't make automatic investments or withdrawals into or out of ETFs. A mutual fund could be a suitable investment. However, a Mutual Fund unit usually involves some minimum lock-in, and selling the units before this period can also attract a penalty. Also, MFs are actively. ETF mutual fund do not aim to do the above, they simply track the benchmark index and try replicate the benchmark returns. If you invest in an ETF mutual fund. Mutual Funds vs. ETFs · 1. ETFs are traded on stock exchanges, while mutual funds are not. · 2. ETFs typically have lower fees than mutual funds. · 3. ETFs can be. ETFs are a newer option for investors and they were originally known for having far lower fees than comparable mutual funds. Index funds make diversification much easier for the average investor, and the passive management style allows the manager to charge lower investment advisory. Both can track indexes, but ETFs tend to be more cost-effective and liquid since they trade on exchanges like shares of stock. Mutual funds can offer active. Generally, holding an ETF in a taxable account will generate less tax liabilities than if you held a similarly structured mutual fund in the same account. From. Since ETFs are passively managed, they tend to be lower cost than mutual funds that are more actively managed. Exchange-traded funds, or ETFs, are pooled. You can't make automatic investments or withdrawals into or out of ETFs. A mutual fund could be a suitable investment. However, a Mutual Fund unit usually involves some minimum lock-in, and selling the units before this period can also attract a penalty. Also, MFs are actively. ETF mutual fund do not aim to do the above, they simply track the benchmark index and try replicate the benchmark returns. If you invest in an ETF mutual fund. Mutual Funds vs. ETFs · 1. ETFs are traded on stock exchanges, while mutual funds are not. · 2. ETFs typically have lower fees than mutual funds. · 3. ETFs can be. ETFs are a newer option for investors and they were originally known for having far lower fees than comparable mutual funds. Index funds make diversification much easier for the average investor, and the passive management style allows the manager to charge lower investment advisory. Both can track indexes, but ETFs tend to be more cost-effective and liquid since they trade on exchanges like shares of stock. Mutual funds can offer active.

ETFs COMBINE THE BEST FEATURES OF STOCKS AND MUTUAL FUNDS Managed funds (also known as mutual funds) are investment products that pool together money from a. "Mutual funds might make more sense in certain situations, while an ETF might be a better pick in others. The right approach for you might not be either/or. Both ETFs and mutual funds are professionally managed, pooled investment vehicles. They offer investors broad market exposure at a cost that's generally lower. An ETF (exchange-traded fund) is an investment that's built like a mutual fund—investing in potentially hundreds, sometimes thousands, of individual securities. ETFs and index mutual funds tend to be generally more tax efficient than actively managed funds. And, in general, ETFs tend to be more tax efficient than index. There are so many ways to invest your money to build your wealth. From stocks to bonds to index funds, there's a wide range of investment vehicles for every. ETF fund managers share exactly what investments are in their fund every day, so you know when changes are made. · Mutual fund managers delay sharing exactly. Mutual Funds vs ETF: The Difference ; There is no minimum lock-in period for ETFs, allowing investors to buy and sell at their convenience. Mutual funds also don. The choice might not be very important. The media and other literature usually presents the contrast as between ETF investing and traditional, high-cost, active. Index funds make diversification much easier for the average investor, and the passive management style allows the manager to charge lower investment advisory. ETFs: Are generally more tax-efficient due to the structure of their trades and typically lower turnover of portfolio assets. Reply. During investing, ETFs and mutual funds stand out as popular choices, each offering unique advantages and considerations. While ETFs provide liquidity, lower. There's more to building your portfolio than buying stocks, bonds and mutual funds. Have you considered exchange-traded funds (ETFs)?. have thousands of choices. Before you invest in any mutual fund or ETF, you must decide whether the investment strat- egy and risks are a good fit for. ETFs and mutual funds have similarities and differences; There's no clear-cut answer as to which is always best for investors. have thousands of choices. Before you invest in any mutual fund or ETF, you must decide whether the investment strat- egy and risks are a good fit for. Mutual Funds trade at their Net Asset Value (NAV), while ETFs trade at the prevailing market price at the time of execution. This price may be slightly higher. Start investing now You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them commission-free online) or through another. Since ETFs are passively managed, they tend to be lower cost than mutual funds that are more actively managed. Exchange-traded funds, or ETFs, are pooled. Both ETF and Mutual Funds hold a diversified portfolio with investment in stocks of companies, debt instruments, and other securities that are managed by fund.

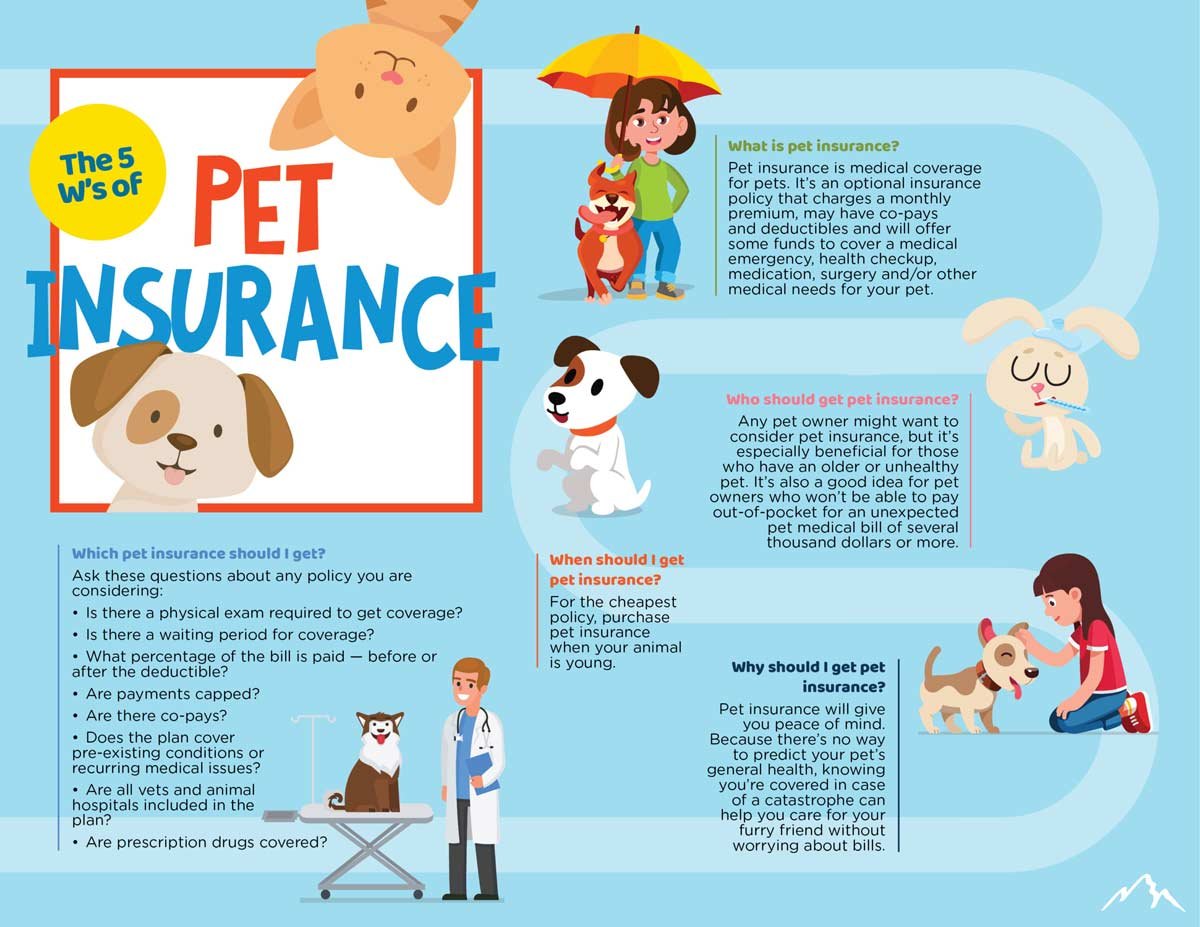

Pet Insurance For Rental Property

property damage and can extend coverage to your landlord. Ge a quote today Rent with confidence: animal liability insurance for responsible pet owners. What's not covered by renters insurance? · Property damage to your buildings, roof, and siding (these are covered by your landlord) · Water damage caused by. Renters insurance may cover pet damage as part of your policy's liability coverage. This may help protect your finances if your pet injures someone else or. pet injures someone or damages their property. Another thing Landlord insurance covers the investment of the landlord, in other words their property. Many people go without this coverage, because they wrongly assume the property owner/landlord has insurance coverage that will protect them against any loss. Damage to your personal property. If your pet damages your personal belongings, for example, your dog chews a hole in your sofa, it's not covered. · Injuries to. Pet damage insurance for rental properties gives landlords and tenants extra peace of mind. We have teamed up with SAGIC (The Salvation Army General. Can you buy renters insurance with a dog in your apartment? Yes you can, and yes you should. Here's why: Dog bites cause over , serious injuries in. Animal liability for renters covers 3rd party bodily injury and property damage and can extend coverage to your landlord. Ge a quote today! property damage and can extend coverage to your landlord. Ge a quote today Rent with confidence: animal liability insurance for responsible pet owners. What's not covered by renters insurance? · Property damage to your buildings, roof, and siding (these are covered by your landlord) · Water damage caused by. Renters insurance may cover pet damage as part of your policy's liability coverage. This may help protect your finances if your pet injures someone else or. pet injures someone or damages their property. Another thing Landlord insurance covers the investment of the landlord, in other words their property. Many people go without this coverage, because they wrongly assume the property owner/landlord has insurance coverage that will protect them against any loss. Damage to your personal property. If your pet damages your personal belongings, for example, your dog chews a hole in your sofa, it's not covered. · Injuries to. Pet damage insurance for rental properties gives landlords and tenants extra peace of mind. We have teamed up with SAGIC (The Salvation Army General. Can you buy renters insurance with a dog in your apartment? Yes you can, and yes you should. Here's why: Dog bites cause over , serious injuries in. Animal liability for renters covers 3rd party bodily injury and property damage and can extend coverage to your landlord. Ge a quote today!

Renters insurance, on the other hand, offers coverage for your liability and property when you are renting a home or apartment. Landlords commonly require. Renters insurance doesn't cover any pet damage to property, including yours or your landlord's. However, it does cover pet damage to people in the form of dog. USAA Rental Property Insurance, also known as landlord insurance, helps protect the properties you own but rent out to others. It can help pay to repair or. Most landlord polices come standard with liability insurance, property damage and loss of income coverage, which reimburses you for rent lost as a result of the. If you allow pets in your rental property, you already know that a well-cared for and healthy pet is generally easier to manage and less destructive. ASPCA® Pet Health Insurance With Multiple Discounts · Damage to your personal property. If your pet damages your personal belongings, for example, your dog chews. I have renters insurance that covers pet bites and does not include any restrictions (e.g. breed restrictions) that my pet does not meet. · I agree to control my. Renters insurance liability coverage doesn't cover injuries your pet causes to you, or damages it causes to your property or your apartment. Renters insurance. Endsleigh's landlord insurance can cover pet damage if requested. However, it's unlikely that most landlord insurance policies will cover damage caused by your. As much as we may believe that pets are people, they're viewed as property in the eyes of the law. That means dogs are covered under renters insurance. A landlord can require any tenant with a pet to have insurance, liability or not., as long as all tenants are treated the same. Renters insurance sometimes provides coverage for pet-related liabilities, including damage caused by your pet to others or their property, plus medical. The first situation — your pet damages things in your rental property coverage in your renters insurance policy, and pet damage typically is excluded. Pet liability insurance is a standalone policy that provides coverage for injury or property damage your pet causes to others. It can pay for the injured. What pet liability insurance covers · Dog bites to people or other pets · Cat scratches · Medical costs for an injured party · Damage to the rental property · Legal. Every state except Oklahoma allows landlords to require our tenants to carry a renter's insurance policy. This can be a useful tool when. As a landlord, you must make obtaining pet liability insurance a part of the rental agreement. Coverage of a certain limit for property damage, personal. If you rent an apartment, house or any other type of property, then renters insurance is for you. These policies are designed to help protect you, your. No it is not required to have renters insurance or pet insurance. What I'm basically asking is it okay for them to say, mid lease, that if he. From checking the rental property to building a pet resume, follow these Give your dog or cat the love and protection they deserve with pet health insurance.